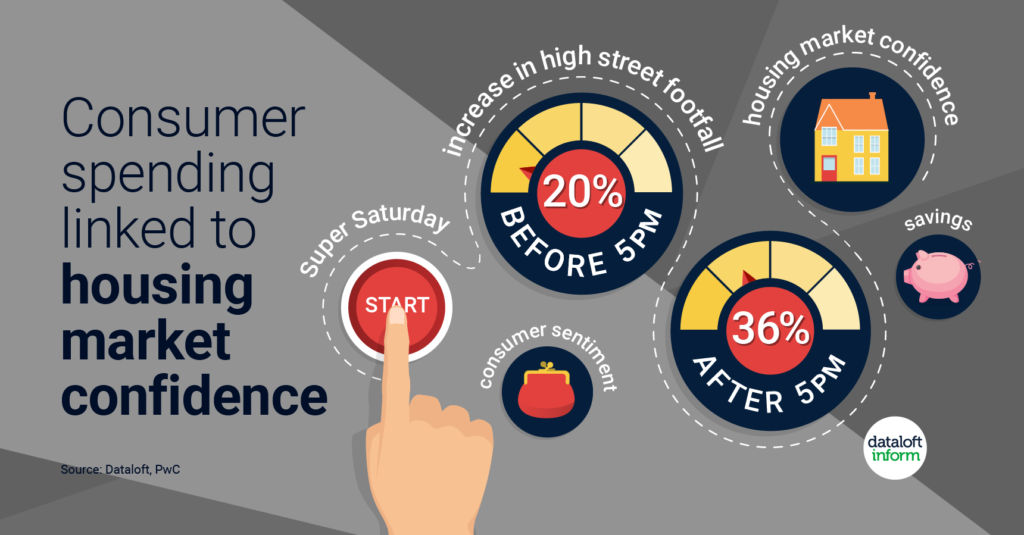

As restaurants, pubs, cafes, and hairdressers have now been open for a few weeks, it has been interesting to watch how this increase in highstreet footfall has affected the housing market. PwC reports on money in consumers’ pockets – consumer spending trends are closely linked to housing market confidence. There was a 20% weekly increase in footfall on Saturday 4th July and after 5pm this...

As restaurants, pubs, cafes, and hairdressers have now been open for a few weeks, it has been interesting to watch how this increase in highstreet footfall has affected the housing market.

PwC reports on money in consumers’ pockets – consumer spending trends are closely linked to housing market confidence.

There was a 20% weekly increase in footfall on Saturday 4th July and after 5pm this rose to 36%. However, overall number of visits to the high street in England is down 56% on last year.

PwC reported an increase in consumer sentiment in June, the majority of households so far unaffected financially and 1 in 5 households are saving money.

With more money in consumers’ pockets, VAT reductions for the hospitality industry, creation of the eat out to help scheme, we hope high street footfall will continue to increase. However, much hangs on employment levels after furlough ends in October.

Another much welcome boost to confidence in the housing market is the new Stamp Duty Holiday which sees house-hunters able to save significant amounts on purchases up to £500k.

Source: Dataloft, PwC

By

By

Share this with

Email

Facebook

Messenger

Twitter

Pinterest

LinkedIn

Copy this link